Consumers are becoming more aware of mobile commerce and more likely to participate therein

Retale, a location-based shopping and marketing firm, has released the results of a recent survey it conducted in the United States. The survey found that consumer attitude regarding mobile payments has begun to shift. In the past, many people had been somewhat leery of mobile commerce, concerned that mobile platforms were not as secure as they often claimed to be. As people have become more exposed to mobile payments, however, they are growing more interested in the concept.

56% of consumers are willing to use their mobile device to pay for products they are shopping for

According to the survey, 56% of consumers noted that they would be willing to participate in mobile commerce to purchase a gift for others or something for themselves. A massive 91% of respondents noted that they had already made a mobile payment in order to purchase a product. Many consumers have mobile commerce on their mind relatively frequently. Some noted that they look for mobile payment support when they visit physical stores.

Consumers favor the convenience of mobile commerce

Convenience is the main reason behind consumer interest in mobile payments. Approximately 58% of consumers said that they favor the convenience that mobile commerce offers over more traditional forms of commerce. Despite the benefits of mobile commerce, consumers still have concerns, especially when it comes to security.

Convenience is the main reason behind consumer interest in mobile payments. Approximately 58% of consumers said that they favor the convenience that mobile commerce offers over more traditional forms of commerce. Despite the benefits of mobile commerce, consumers still have concerns, especially when it comes to security.

Security issues remain the greatest barrier between consumers and mobile payments

The survey found that the greatest concern that consumers participating in mobile commerce have has to do with security. Recent high-profile cyber attacks on retailers have thrust the security issues that mobile commerce faces into the limelight. Many consumers have expressed their worry that their financial information is not safe when they are using a variety of mobile services. Others are concerned that mobile payment platforms can be accessed to easily if their smartphone or other device is stolen. Still others have expressed concerns regarding how difficult it is to keep track of their spending on some mobile platforms.

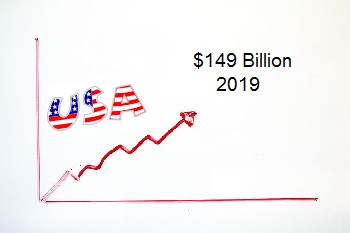

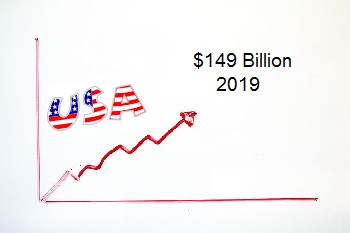

Report highlights the aggressive growth of mobile commerce in the United States

A new report from Forrester Research predicts that mobile payments volume in the United States will reach $149 billion in 2019, up from the $50 billion in payments volume currently. Mobile commerce is still a relatively new concept, only rising to prominence over the past few years. In a relatively short amount of time, consumers have become enthralled with the idea that they can make payments for products online and at physical stores with little more than their smarthphones and the demand for mobile-centric services is rising quickly.

Mobile payment services may become mainstream within the next five years

Several companies have been working to offer consumers mobile commerce services that are both convenient and secure, but none have yet been able to build a platform that has seen mainstream acceptance. Consumers seem to prefer using a wide variety of platforms and services, switching from one to the next as they see fit. Within the next five years, however, the report predicts that this will change and some platforms will become favored among consumers, while others may fade into obsolescence.

Retailers are feeling pressure to engage mobile consumers more effectively

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store mobile payments is growing quickly and retailers are feeling pressure to address this demand and engage mobile consumers. Some retailers are building their own mobile commerce platforms, while others reach out to companies like Apple and Google in order to connect with mobile consumers.

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store mobile payments is growing quickly and retailers are feeling pressure to address this demand and engage mobile consumers. Some retailers are building their own mobile commerce platforms, while others reach out to companies like Apple and Google in order to connect with mobile consumers.

In-store mobile transaction volume may reach $34 billion by 2019

The report predicts that Apple Pay will help accelerate growth in physical mobile payments. According to the report, in-store mobile transaction volume will reach $34 billion in the U.S. by 2019. Services like Apple Pay will play a considerable role in powering this growth. As retailers see more success with in-store mobile payments, they may choose to become more aggressive in the mobile commerce field.

Convenience is the main reason behind consumer interest in mobile payments. Approximately 58% of consumers said that they favor the convenience that mobile commerce offers over more traditional forms of commerce. Despite the benefits of mobile commerce, consumers still have concerns, especially when it comes to security.

Convenience is the main reason behind consumer interest in mobile payments. Approximately 58% of consumers said that they favor the convenience that mobile commerce offers over more traditional forms of commerce. Despite the benefits of mobile commerce, consumers still have concerns, especially when it comes to security.

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store