Survey shows that retailers are becoming more interested in new payment technologies and services

Retailers in Europe and the Middle East are planning to invest in new payment technologies in the coming years, according to a survey from ACI Worldwide and Ovum. Many retailers are beginning to see a trend among consumers that involves the use of mobile devices to shop for and purchase products. As this trend become more powerful, retailers are beginning to feel the pressure to engage mobile consumers more effectively or risk being left behind by these consumers.

Retailers in Europe and the Middle East have plans to embrace mobile payments within the next 24 months

According to the survey, more than two thirds of European and Middle Eastern retailers have plans to invest in mobile payments technology within the next 18 to 24 months. These retailers are citing real-time clearing and settlement capabilities and the growing popularity of loyalty programs as the reasons behind these investments. QR codes, in particular, have shown great appeal to retailers that want to engage consumers in an effective manner, as these codes have become quite powerful mobile payments tools.

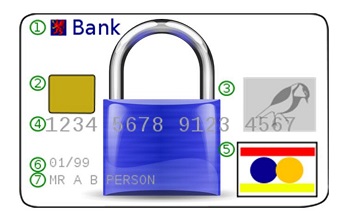

Security concerns are slowing the adoption of mobile payments in the retail industry

The survey suggests that unfounded security fears have slowed the adoption of mobile payments among retailers. Many companies are concerned with their ability to keep consumers information secure when using a mobile payments platform. Notably, however, a relatively small number of retailers have fallen prey to cyber attacks focused on the mobile sector. The survey suggests that retailers are more comfortable with relying on older, less secure payment platforms that have proven to have security issues in the past.

The survey suggests that unfounded security fears have slowed the adoption of mobile payments among retailers. Many companies are concerned with their ability to keep consumers information secure when using a mobile payments platform. Notably, however, a relatively small number of retailers have fallen prey to cyber attacks focused on the mobile sector. The survey suggests that retailers are more comfortable with relying on older, less secure payment platforms that have proven to have security issues in the past.

Retailers believe that consumers want more payment options

The survey shows that 93% of retailers believe that consumers want more options when it comes to paying for products. As such, mobile payments are becoming a more prominent focus for many companies. One of the challenges of embracing mobile payments, however, is the relatively high investment needed to purchase mobile point-of-sale systems and other mobile-centric platforms.

For those interested in mobile commerce, the new security standards could be seen as a boon. Security has long been an issue that the mobile world has had to manage, and the issue has become more important to address with the growing number of people using their smartphones to make purchases. The new point-of-sale terminals that retailers will have to adopt will support

For those interested in mobile commerce, the new security standards could be seen as a boon. Security has long been an issue that the mobile world has had to manage, and the issue has become more important to address with the growing number of people using their smartphones to make purchases. The new point-of-sale terminals that retailers will have to adopt will support