New study shows that NFC payments are becoming more common among consumers in the retail sector

NFC-based mobile payments are on the rise throughout the world, according to a new study from Strategy Analytics. The study highlights the growing adoption and availability of NFC-enabled mobile devices. These devices are equipped with NFC chips, which allow them to engage with interactive marketing materials, share digital information from one device to another, and participate in mobile commerce. As these devices become more plentiful among consumers, people are using them to shop online and purchase products from physical stores.

Study predicts that NFC-based mobile payments will represent $130 billion in global spending by 2020

The study shows that NFC-based mobile payments will account for $130 billion in global consumer retail spending by 2020. This is roughly similar to 254 million mobile consumers making as many as five mobile payments every month of $9 or less. The growing availability of NFC-enabled mobile devices and services is powering this growth in the mobile commerce field. One of the latest services to launch, Apple Pay, is having a profound impact on the growth of NFC-based payments.

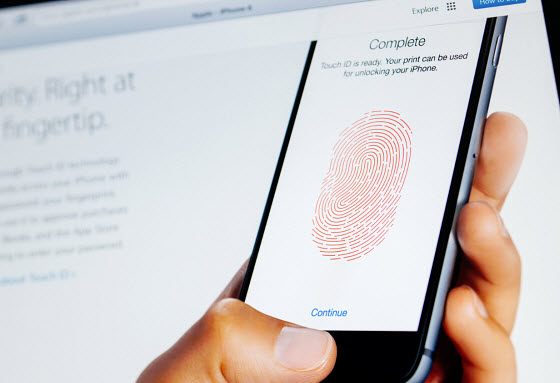

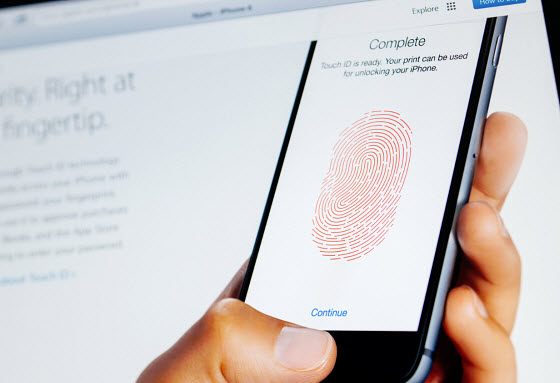

Apple Pay helps promote mobile spending through NFC technology

Apple Pay was launched at the end of October this year, and has since become a prominent payment platform among iOS users. The service launched with the support of a wide range of retail partners, many of whom also adopted mobile point-of-sale systems to accommodate the growing number of those paying for products with their mobile devices. Services like Apple Pay are expected to continue powering the growth of the mobile payments field.

Apple Pay was launched at the end of October this year, and has since become a prominent payment platform among iOS users. The service launched with the support of a wide range of retail partners, many of whom also adopted mobile point-of-sale systems to accommodate the growing number of those paying for products with their mobile devices. Services like Apple Pay are expected to continue powering the growth of the mobile payments field.

Some retailers are unconvinced of the value of NFC technology

Retailers have been relatively slow to embrace NFC technology. The cost of adopting NFC-enabled point-of-sale systems is often seen as too high for some retailers, while others are not yet convinced that mobile commerce is anything but a passing trend. As NFC devices become more popular among consumers, these retailers may change their minds and begin supporting mobile commerce more aggressively.

Apple Pay has managed to find success where other services have failed

Apple Pay has been finding significant success as a mobile payments service in the few months since its launch, but the service could face challenges in the future. When Apple launched its payment service in September of this year, many believed that it would be a game changer in the mobile commerce space. The service launched with the support of several major retail companies and financial institutions and has been gaining more support from these sectors since.

Report shows that mobile payments among iOS users is rising dramatically

A recent report released by Investment Technology Group found that Apple Pay has already had a significant impact. The report shows that 60% of new Apple Pay users made a payment through the service multiple times during November, suggesting that the platform is engaging consumers effectively. By comparison, 20% of new PayPal customers used the company’s service during the same period. The report also shows that Apple Pay customers used the service approximately 1.4 times per week.

Consumers are likely to continue using Apple Pay with merchants they already purchase products from

The retail partners that Apple has acquired for the launch of Apple Pay have helped the service flourish. Those with iOS devices have been without a comprehensive mobile payments solution for some time, and many were happy to use Apple Pay when it was launched in September. The report from Investment Technology Group shows that Apple Pay users were more likely to continue using the service with the same retailers numerous times, with 66% of consumers using the service at the same merchant for future transactions.

The retail partners that Apple has acquired for the launch of Apple Pay have helped the service flourish. Those with iOS devices have been without a comprehensive mobile payments solution for some time, and many were happy to use Apple Pay when it was launched in September. The report from Investment Technology Group shows that Apple Pay users were more likely to continue using the service with the same retailers numerous times, with 66% of consumers using the service at the same merchant for future transactions.

Mobile payments is coming under regulatory scrutiny

Despite the success of Apple Pay, it could be subject to restrictive financial regulations in the future. Apple may be subject to examination by the Consumer Financial Protection Bureau, which has grown somewhat concerned about the mobile payments space recently. While the agency has not yet taken steps to examine companies like Apple and determine whether or not they must comply with the Consumer Financial Protection Act, mobile payments have been falling under more regulatory scrutiny recently.

Apple Pay was launched at the end of October this year, and has since become a prominent payment platform among iOS users. The service launched with the support of a wide range of retail partners, many of whom also adopted mobile point-of-sale systems to accommodate the growing number of those paying for products with their mobile devices. Services like Apple Pay are expected to continue powering the growth of the mobile payments field.

Apple Pay was launched at the end of October this year, and has since become a prominent payment platform among iOS users. The service launched with the support of a wide range of retail partners, many of whom also adopted mobile point-of-sale systems to accommodate the growing number of those paying for products with their mobile devices. Services like Apple Pay are expected to continue powering the growth of the mobile payments field.

The retail partners that Apple has acquired for the launch of Apple Pay have helped the service flourish. Those with iOS devices have been without a comprehensive mobile payments solution for some time, and many were happy to use Apple Pay when it was launched in September. The report from Investment

The retail partners that Apple has acquired for the launch of Apple Pay have helped the service flourish. Those with iOS devices have been without a comprehensive mobile payments solution for some time, and many were happy to use Apple Pay when it was launched in September. The report from Investment