BWild |

November 21, 2014

Powa raises $80 million to bring its mobile services to the United States

Powa, a commerce specialist operating primarily in the United Kingdom, will be bringing its mobile commerce service to the United States. The company has raised $80 million in its most recent round of funding, with Wellington Management leading investments. This funding will allow the company to launch its digital payments system in the U.S., expanding the mobile commerce options that are available in the country and providing businesses with a new way to engage consumers.

2014 holiday season may be the biggest yet for mobile commerce

Powa will be launching its service in the U.S. before the holiday season. During the holidays, mobile commerce is expected to see significant growth. Last year, consumers showed a great deal of favor for mobile shopping, praising its convenience and the fact that they were able to avoid the crowds that swarmed stores during the holidays. This year’s holiday season is expected to be a major success for the mobile commerce space, largely due to the number of retailers that have entered into the space.

Small businesses are looking to engage mobile consumers in a more effective way

Small businesses that want to make use of a mobile point-of-sale payment system in their stores, as well as use a conventional e-commerce website, will be able to take advantage of Powa’s services. The company’s services are designed with mobile commerce in mind, meant to help businesses engage mobile consumers in an effective way.

Small businesses that want to make use of a mobile point-of-sale payment system in their stores, as well as use a conventional e-commerce website, will be able to take advantage of Powa’s services. The company’s services are designed with mobile commerce in mind, meant to help businesses engage mobile consumers in an effective way.

PowaTags are coming to the United States as Powa expands its market reach

Powa is also bringing its PowaTags to the United States. These tags can be scanned by consumers with smartphones, allowing them to purchase these products directly from their device. These tags can integrated into printed marketing materials, streamlining the shopping process and allowing consumers to purchase products directly from advertisements they see. These tags can also be embedded into dynamic content, such as streamed broadcasts and videos. Powa’s services may be particularly attractive to businesses looking to engage mobile consumers during the upcoming holiday season.

Report highlights the aggressive growth of mobile commerce in the United States

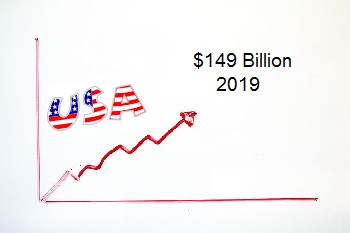

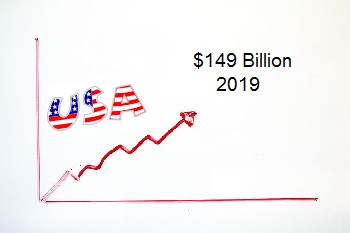

A new report from Forrester Research predicts that mobile payments volume in the United States will reach $149 billion in 2019, up from the $50 billion in payments volume currently. Mobile commerce is still a relatively new concept, only rising to prominence over the past few years. In a relatively short amount of time, consumers have become enthralled with the idea that they can make payments for products online and at physical stores with little more than their smarthphones and the demand for mobile-centric services is rising quickly.

Mobile payment services may become mainstream within the next five years

Several companies have been working to offer consumers mobile commerce services that are both convenient and secure, but none have yet been able to build a platform that has seen mainstream acceptance. Consumers seem to prefer using a wide variety of platforms and services, switching from one to the next as they see fit. Within the next five years, however, the report predicts that this will change and some platforms will become favored among consumers, while others may fade into obsolescence.

Retailers are feeling pressure to engage mobile consumers more effectively

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store mobile payments is growing quickly and retailers are feeling pressure to address this demand and engage mobile consumers. Some retailers are building their own mobile commerce platforms, while others reach out to companies like Apple and Google in order to connect with mobile consumers.

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store mobile payments is growing quickly and retailers are feeling pressure to address this demand and engage mobile consumers. Some retailers are building their own mobile commerce platforms, while others reach out to companies like Apple and Google in order to connect with mobile consumers.

In-store mobile transaction volume may reach $34 billion by 2019

The report predicts that Apple Pay will help accelerate growth in physical mobile payments. According to the report, in-store mobile transaction volume will reach $34 billion in the U.S. by 2019. Services like Apple Pay will play a considerable role in powering this growth. As retailers see more success with in-store mobile payments, they may choose to become more aggressive in the mobile commerce field.

Small businesses that want to make use of a mobile point-of-sale payment system in their stores, as well as use a conventional e-commerce website, will be able to take advantage of Powa’s services. The company’s services are designed with mobile commerce in mind, meant to help businesses engage mobile consumers in an effective way.

Small businesses that want to make use of a mobile point-of-sale payment system in their stores, as well as use a conventional e-commerce website, will be able to take advantage of Powa’s services. The company’s services are designed with mobile commerce in mind, meant to help businesses engage mobile consumers in an effective way.

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store