The mobile space is driving the evolution of commerce as a whole

It has been 10 years since PayPal launched its first mobile payments service. To celebrate the anniversary of the service, the company has released information to show its exponential growth over its long history. This information is visualized in a chart that was released by PayPal earlier this week. According to PayPal CEO Dan Schulman, the mass adoption of mobile commerce has created a significant shift in the way people spend money. This has begun to change the nature of commerce with consumers relying more heavily on the digital space.

$66 billion in mobile transactions were processed by PayPal in 2015

According to PayPal, one-third of the 4.9 billion payments processed by the company last year were made through mobile devices. This accounts for some $66 billion in mobile transactions. The company believes that the growing prominence of mobile payments services will lead to a change in the commerce space over the next decade. This change may accelerate as more businesses begin supporting mobile transactions and shoppers relying on their smartphones and tablets.

Global mobile payments could reach $4 trillion by 2020

In the United States, mobile commerce exceeded $100 billion in transactions in 2014. These transactions have continued to grow since, with more consumers becoming comfortable with the prospect of using mobile devices to make purchases. By 2020, mobile transactions could reach more than $4 trillion globally, according to IDC, a market research and analysis firm. With new payment services becoming more secure, more consumers are likely to participate in the mobile commerce space, giving PayPal and other companies new opportunities to expand their mobile initiatives.

In the United States, mobile commerce exceeded $100 billion in transactions in 2014. These transactions have continued to grow since, with more consumers becoming comfortable with the prospect of using mobile devices to make purchases. By 2020, mobile transactions could reach more than $4 trillion globally, according to IDC, a market research and analysis firm. With new payment services becoming more secure, more consumers are likely to participate in the mobile commerce space, giving PayPal and other companies new opportunities to expand their mobile initiatives.

Improved security makes consumers more comfortable with mobile commerce

Consumer adoption of mobile commerce has been heavily influenced by the security and convenience of payment services. Many had consider mobile transactions to be risky as they believed their financial information would be exposed to theft and exploitation. Indeed, some services have been impacted by major data breaches in the past, but these events have served to strengthen security in recent years, making mobile payments more attractive to consumers.

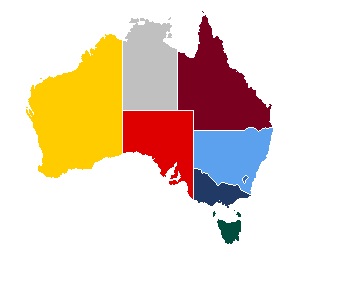

Many banks in Australia have begun investing in mobile payments, hoping to provide better services to consumers with smartphones. These investments are beginning to focus on security features, hoping to make the mobile commerce space safer for consumers. Security has long been a major issue for consumers, many of whom believe that their financial information is at risk of exploitation. These concerns have prevented many people from participating in mobile commerce, but as payment services become more secure, many consumers are beginning to use their devices to shop online and in physical stores.

Many banks in Australia have begun investing in mobile payments, hoping to provide better services to consumers with smartphones. These investments are beginning to focus on security features, hoping to make the mobile commerce space safer for consumers. Security has long been a major issue for consumers, many of whom believe that their financial information is at risk of exploitation. These concerns have prevented many people from participating in mobile commerce, but as payment services become more secure, many consumers are beginning to use their devices to shop online and in physical stores.