Mobile commerce may become more refined in 2015

The future of mobile payments is still somewhat uncertain, despite the growing popularity of mobile commerce. In 2015, there may be many changes seen in the mobile payments space, especially as new services become available and more people become comfortable with the idea of paying for goods and services from their phones. Security may become a major issue in 2015 as organizations specializing in mobile commerce begin to take steps to ensure that consumer information is safe from exploitation.

Apple Pay may serve to bolster the power of the mobile payments industry

Much of the conversation regarding mobile payments is likely to revolve around Apple Pay this year. According to a recent report from Forrester Research, the new payment service from Apple is expected to energize the mobile market. The report suggests that Apple Pay will drive the adoption of new wearable devices that have been developed by Apple and help bolster mobile payments overall. The report predicts that mobile payments in the United States will grow to $142 billion by 2019, with new mobile services, like Apple Pay, making it easier for consumers to spend money through their mobile devices.

Security will become a major priority in 2015

Security budgets are likely to increase across numerous industries this year. Many businesses have begun to take security more seriously because of the high-profile data breaches that were seen in 2014. These companies are investing more in security measures, especially those designed for the mobile space. The report from Forrester suggests that security spending will increase this year, but so too will the number of data breaches.

Security budgets are likely to increase across numerous industries this year. Many businesses have begun to take security more seriously because of the high-profile data breaches that were seen in 2014. These companies are investing more in security measures, especially those designed for the mobile space. The report from Forrester suggests that security spending will increase this year, but so too will the number of data breaches.

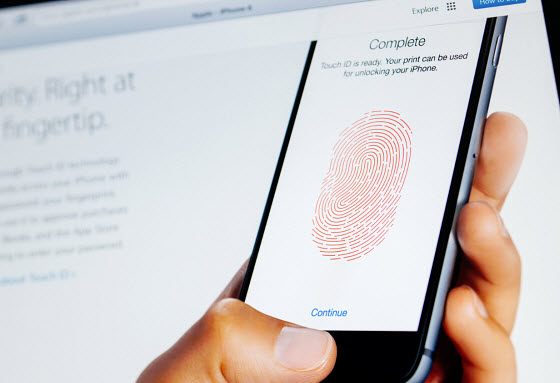

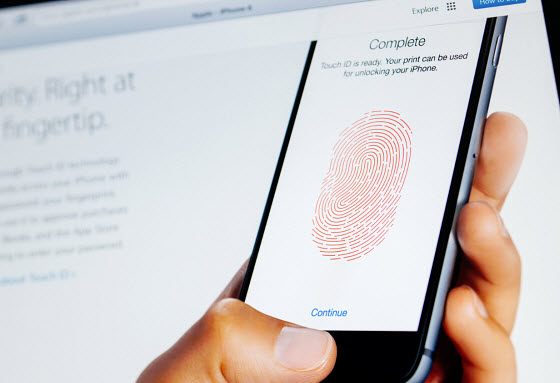

Consumers are becoming more comfortable with mobile payment services

Consumers are expected to become more confident in mobile commerce in the coming year. New services are being launched that include features that consumers have been demanding. These services are also becoming more secure and offering better shopping and payment experiences. As such, consumers are becoming more comfortable with using these services to pay for the products that they are interested in.

Apple Pay has managed to find success where other services have failed

Apple Pay has been finding significant success as a mobile payments service in the few months since its launch, but the service could face challenges in the future. When Apple launched its payment service in September of this year, many believed that it would be a game changer in the mobile commerce space. The service launched with the support of several major retail companies and financial institutions and has been gaining more support from these sectors since.

Report shows that mobile payments among iOS users is rising dramatically

A recent report released by Investment Technology Group found that Apple Pay has already had a significant impact. The report shows that 60% of new Apple Pay users made a payment through the service multiple times during November, suggesting that the platform is engaging consumers effectively. By comparison, 20% of new PayPal customers used the company’s service during the same period. The report also shows that Apple Pay customers used the service approximately 1.4 times per week.

Consumers are likely to continue using Apple Pay with merchants they already purchase products from

The retail partners that Apple has acquired for the launch of Apple Pay have helped the service flourish. Those with iOS devices have been without a comprehensive mobile payments solution for some time, and many were happy to use Apple Pay when it was launched in September. The report from Investment Technology Group shows that Apple Pay users were more likely to continue using the service with the same retailers numerous times, with 66% of consumers using the service at the same merchant for future transactions.

The retail partners that Apple has acquired for the launch of Apple Pay have helped the service flourish. Those with iOS devices have been without a comprehensive mobile payments solution for some time, and many were happy to use Apple Pay when it was launched in September. The report from Investment Technology Group shows that Apple Pay users were more likely to continue using the service with the same retailers numerous times, with 66% of consumers using the service at the same merchant for future transactions.

Mobile payments is coming under regulatory scrutiny

Despite the success of Apple Pay, it could be subject to restrictive financial regulations in the future. Apple may be subject to examination by the Consumer Financial Protection Bureau, which has grown somewhat concerned about the mobile payments space recently. While the agency has not yet taken steps to examine companies like Apple and determine whether or not they must comply with the Consumer Financial Protection Act, mobile payments have been falling under more regulatory scrutiny recently.

Security budgets are likely to increase across numerous industries this year. Many businesses have begun to take security more seriously because of the high-profile data breaches that were seen in 2014. These companies are investing more in security measures, especially those designed for the mobile space. The report from Forrester suggests that security spending will increase this year, but so too will the number of data breaches.

Security budgets are likely to increase across numerous industries this year. Many businesses have begun to take security more seriously because of the high-profile data breaches that were seen in 2014. These companies are investing more in security measures, especially those designed for the mobile space. The report from Forrester suggests that security spending will increase this year, but so too will the number of data breaches.

The retail partners that Apple has acquired for the launch of Apple Pay have helped the service flourish. Those with iOS devices have been without a comprehensive mobile payments solution for some time, and many were happy to use Apple Pay when it was launched in September. The report from Investment

The retail partners that Apple has acquired for the launch of Apple Pay have helped the service flourish. Those with iOS devices have been without a comprehensive mobile payments solution for some time, and many were happy to use Apple Pay when it was launched in September. The report from Investment