National Australia Bank is finding more momentum in the mobile payments space

Mobile commerce is gaining momentum in Australia, according to the National Australia Bank. The bank has announced that the uptake of new payment platforms has exceeded expectations, with some 18,000 consumers downloading the company’s NAB Pay application. This accounts for approximately 60,000 mobile transactions since the service was launched earlier this year. Other payment platforms are experiencing similar growth in the country as more consumers become comfortable with the concept of mobile commerce.

NAB Pay is gaining popularity among consumers interested in mobile shopping

The NAB Pay application is particularly popular among those purchasing lunch, coffee, and snacks. These consumers are using the app to make purchases at cafes and fast food restaurants at a higher frequency than those using contactless payment cards. During the work week, transactions made through NAB Pay spike during lunchtime and between 6pm and 7pm. As such, the vast majority of transactions are below $100, though some consumers are using NAB Pay to make larger purchases, especially those that are interested in electronics.

Companies are looking to make mobile payments more secure for consumers

Many banks in Australia have begun investing in mobile payments, hoping to provide better services to consumers with smartphones. These investments are beginning to focus on security features, hoping to make the mobile commerce space safer for consumers. Security has long been a major issue for consumers, many of whom believe that their financial information is at risk of exploitation. These concerns have prevented many people from participating in mobile commerce, but as payment services become more secure, many consumers are beginning to use their devices to shop online and in physical stores.

Many banks in Australia have begun investing in mobile payments, hoping to provide better services to consumers with smartphones. These investments are beginning to focus on security features, hoping to make the mobile commerce space safer for consumers. Security has long been a major issue for consumers, many of whom believe that their financial information is at risk of exploitation. These concerns have prevented many people from participating in mobile commerce, but as payment services become more secure, many consumers are beginning to use their devices to shop online and in physical stores.

National Australia Bank is establishing a strong position in the mobile commerce market

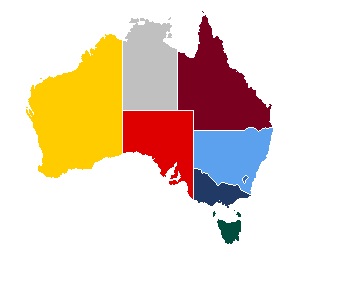

Australia is becoming a prominent mobile payments market, with several organizations looking to bring their new payment services to the country. The National Australia Bank is becoming a major player in this market, but will be competing with other organizations that have already established a foothold in this space.

After downloading the T Pay application, consumers can purchase items with a simple voice command. A store’s point-of-sale system would collect

After downloading the T Pay application, consumers can purchase items with a simple voice command. A store’s point-of-sale system would collect