Alibaba is taking steps to work more closely with firms that are based in India

Alibaba, one of the largest e-commerce companies in the world, is looking into acquiring numerous commerce firms based in India. The Chinese company has been experiencing healthy growth following the success that it saw in 2014 and has taken particular interest in mobile commerce. Indian firms are also beginning to embrace the mobile space, especially as more consumers begin to use their smartphones and tablets to shop online at make payments at physical stores.

Company’s investment strategy involves improving the experience that they provide to consumers

The Chinese company is looking for firms that will improve the services that it offers to consumers. According to an Alibaba spokesperson, the company’s investment strategy focuses on three aspects of its overall business model: Increasing user acquisition and engagement, improving customer experience, and the expansion of products and services. By acquiring Indian firms, particularly those with a focus on mobile commerce, Alibaba expects to make improvements to itself and provide consumers with more valuable services in the future.

Several deals improve Alibaba’s position in the mobile commerce space

Over the past three months, Alibaba has been making efforts to  work with Indian companies of various kinds. In January, the company signed a memorandum of understanding with the Confederation of Indian Industry which will lead to greater business engagements between China and India. In February, a branch of Alibaba acquired a 25% stake in One97 Communications, the parent company of mobile commerce firm Paytm. Last month, Alibaba’s plans hit a snag, as it pulled out of negotiations to take a stake in Snapdeal, another e-commerce firm.

work with Indian companies of various kinds. In January, the company signed a memorandum of understanding with the Confederation of Indian Industry which will lead to greater business engagements between China and India. In February, a branch of Alibaba acquired a 25% stake in One97 Communications, the parent company of mobile commerce firm Paytm. Last month, Alibaba’s plans hit a snag, as it pulled out of negotiations to take a stake in Snapdeal, another e-commerce firm.

Alibaba intends to play a larger role in the growing mobile commerce market

Alibaba has a particular interest in working with small companies. In the mobile commerce space, small companies can often have significant impact on their chosen market. With the rapidly increasing number of people with mobile devices, the mobile commerce market stands to become a very powerful economic force in the near future, which is something that Alibaba wants to have influence over.

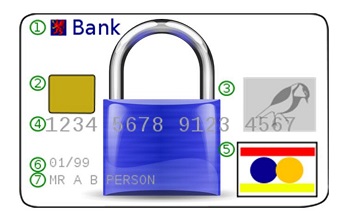

For those interested in mobile commerce, the new security standards could be seen as a boon. Security has long been an issue that the mobile world has had to manage, and the issue has become more important to address with the growing number of people using their smartphones to make purchases. The new point-of-sale terminals that retailers will have to adopt will support

For those interested in mobile commerce, the new security standards could be seen as a boon. Security has long been an issue that the mobile world has had to manage, and the issue has become more important to address with the growing number of people using their smartphones to make purchases. The new point-of-sale terminals that retailers will have to adopt will support