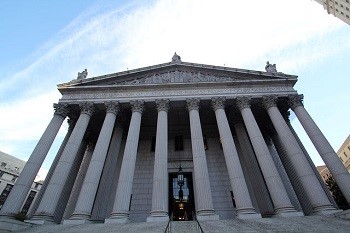

Consumer Financial Protection Bureau files a lawsuit against Sprint

The Consumer Financial Protection Bureau has announced that it has filed a lawsuit against Sprint, one of the largest telecommunications companies in the United States. The lawsuit accuses the company of illegally processing charges through a third party. This marks the first time that the agency has pursued legal action against a telecommunications company and the lawsuit is also bringing more scrutiny to the mobile payments space.

Mobile payments are becoming more favored among consumers that need to pay their bills

Mobile payments have become quite common among consumers. Many people are opting to pay their phone bills and other charges with their mobile devices rather than pay these charges on a home computer. The agency claims that Sprint has allowed third party vendors to place “tens of millions of dollars” in illegal charges. The agency also suggests that Sprint has ignored consumer complaints regarding the matter, collecting money from third party vendors without cause. The Consumer Financial Protection Bureau is now seeking court approval to force Sprint to refund money to consumers and pay fines associated with its alleged actions.

Sprint may not have properly monitored its third party vendors from 2004 to 2013

According to the federal agency, from 2004 to 2013, Sprint outsourced payment processing for digital purchases, such as games and other mobile applications. The agency claims that many consumers were not aware that they would have to pay for these applications because of hidden charges. Sprint is accused of failing to properly monitor its third party vendors and stop them from charging consumers over their mobile devices.

According to the federal agency, from 2004 to 2013, Sprint outsourced payment processing for digital purchases, such as games and other mobile applications. The agency claims that many consumers were not aware that they would have to pay for these applications because of hidden charges. Sprint is accused of failing to properly monitor its third party vendors and stop them from charging consumers over their mobile devices.

Mobile commerce is falling under more scrutiny due to the actions of third party merchants

The mobile commerce space may face more scrutiny from government agencies, depending on how the lawsuit plays out. Potentially malicious activities from some online vendors has shown the need for more regulation in the mobile payments sector. Because mobile commerce is still so new, federal lawmakers have had trouble forming regulations and standards that would govern this emerging market.

Denny |

December 19, 2014

Samsung reportedly in negotiations with mobile commerce firm LoopPay

Google and Apple may soon have strong competition in the mobile commerce field. South Korean electronics company Samsung is reportedly in negotiations with LoopPay, a mobile payments firm based in the United States. While the two companies have not yet officially announced plans to work together, Samsung has been showing strong interest in the mobile commerce space recently. The company sees a great deal of promise in mobile payments and could begin entering into the market within the next few years.

Android devices continues to help mobile commerce grow

Mobile commerce has thrives on the Android platform over the past year. Approximately 83% of the smartphones shipped during the last quarter are powered by the Android operating system, and many of these devices come equipped with mobile payment applications, such as Google Wallet. The Wallet platform has yet to find success among consumers, which has led many to use a wide variety of payment applications. Samsung could capitalize on this by offering a new payment service that would also come pre-installed on Android devices.

Samsung is no stranger to mobile payments

Though Samsung has not made an official entry into the mobile commerce market with its own payment service, the company is no stranger to the market itself. In 2012, Samsung partnered with Visa to released a special version of the Galaxy S3 smartphone, which supported Visa’s payWave technology. Last year, the companies expanded this partnership, bringing payWave supporting devices to 40 European countries. Rumors suggest that Samsung has also begun working with PayPal to support mobile payments on wearable devices.

Though Samsung has not made an official entry into the mobile commerce market with its own payment service, the company is no stranger to the market itself. In 2012, Samsung partnered with Visa to released a special version of the Galaxy S3 smartphone, which supported Visa’s payWave technology. Last year, the companies expanded this partnership, bringing payWave supporting devices to 40 European countries. Rumors suggest that Samsung has also begun working with PayPal to support mobile payments on wearable devices.

Apple may find a strong competitor in Samsung

If Samsung decides to enter into the mobile commerce market, it may become Apple’s most significant competition. Apple released its own mobile payments service earlier this year, which has won praise among retail organizations and consumers alike. The service is only available for one iOS device, however, which has limited its appeal to some consumers. A platform developed by Samsung would likely be available for numerous Android devices, many of which Samsung has developed itself.

According to the federal agency, from 2004 to 2013, Sprint outsourced payment processing for digital purchases, such as games and other mobile applications. The agency claims that many consumers were not aware that they would have to pay for these applications because of hidden charges. Sprint is accused of failing to properly monitor its third party vendors and stop them from charging consumers over their mobile devices.

According to the federal agency, from 2004 to 2013, Sprint outsourced payment processing for digital purchases, such as games and other mobile applications. The agency claims that many consumers were not aware that they would have to pay for these applications because of hidden charges. Sprint is accused of failing to properly monitor its third party vendors and stop them from charging consumers over their mobile devices.

Though Samsung has not made an official entry into the

Though Samsung has not made an official entry into the