Mobile commerce may be more about technology for retailers

Mobile technology has begun to change the way consumers participate in retail and commerce as well as how they interact with one another and the world around them. As such, businesses have been forced to adapt to the changing interests of consumers and embrace mobile engagement strategies and focus more heavily on mobile commerce. Gartner analysts suggest that a focus on mobile commerce is beneficial for retailers, but companies should prioritize their use of mobile technology over commerce initiatives in order to optimize revenue generation.

Embracing technology could help boost revenue

Many technology firms around the world have taken a strong interest in mobile commerce. These firms are offering mobile commerce services to retailers and marketing these services as ways to boost revenue by engaging mobile consumers. Gartner analysts suggest that these services may have little impact on revenue if retailers themselves do not become more accommodating to mobile technology. Optimizing websites so they can be easily viewed on mobile devices and providing consumers with ways to find information with their smartphones and tablets while in physical stores is considered more important than actually having a mobile commerce platform.

Retailers have high hopes for mobile commerce

Retailers have high hopes for mobile commerce

A recent Gartner survey suggests that the world’s leading retailers have high hopes for the mobile space as well as e-commerce. The survey shows that retailers expect the majority of their sales to continue coming from physical stores, but 14.6% will come from e-commerce and 6.5% will come from mobile commerce by 2017. If retailers do not focus more on accommodating mobile technology, however, they may miss out on potential revenue from consumers eager to spend money through their mobile devices.

Mobile sector continues to evolve

Return on investment can be a tricky subject in the world of mobile commerce. There are a wide range of platforms available to consumers, but none of these have yet established themselves as a leader. Moreover, mobile commerce itself is continuing to evolve. The sector is moving away from NFC technology, which has formed its backbone for the past few years. As mobile commerce changes, ways to generate revenue through this sector are becoming somewhat vague.

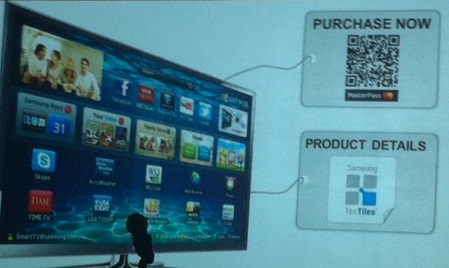

McLaughlin stated that although mobile payments are important in terms of the use of smartphones, the true focus is about building a digital network. Within the demonstrations that were made of the MasterCard technology, a smartphone was used, but so was a watch and a credit card, for example. In fact, it was mentioned that the service has already been effectively tested with Google Glass augmented reality glasses, though they did not have any specific announcement about plans for that device.

McLaughlin stated that although mobile payments are important in terms of the use of smartphones, the true focus is about building a digital network. Within the demonstrations that were made of the MasterCard technology, a smartphone was used, but so was a watch and a credit card, for example. In fact, it was mentioned that the service has already been effectively tested with Google Glass augmented reality glasses, though they did not have any specific announcement about plans for that device. The MasterCard platform uses both NFC technology and

The MasterCard platform uses both NFC technology and