Denny |

December 19, 2014

Samsung reportedly in negotiations with mobile commerce firm LoopPay

Google and Apple may soon have strong competition in the mobile commerce field. South Korean electronics company Samsung is reportedly in negotiations with LoopPay, a mobile payments firm based in the United States. While the two companies have not yet officially announced plans to work together, Samsung has been showing strong interest in the mobile commerce space recently. The company sees a great deal of promise in mobile payments and could begin entering into the market within the next few years.

Android devices continues to help mobile commerce grow

Mobile commerce has thrives on the Android platform over the past year. Approximately 83% of the smartphones shipped during the last quarter are powered by the Android operating system, and many of these devices come equipped with mobile payment applications, such as Google Wallet. The Wallet platform has yet to find success among consumers, which has led many to use a wide variety of payment applications. Samsung could capitalize on this by offering a new payment service that would also come pre-installed on Android devices.

Samsung is no stranger to mobile payments

Though Samsung has not made an official entry into the mobile commerce market with its own payment service, the company is no stranger to the market itself. In 2012, Samsung partnered with Visa to released a special version of the Galaxy S3 smartphone, which supported Visa’s payWave technology. Last year, the companies expanded this partnership, bringing payWave supporting devices to 40 European countries. Rumors suggest that Samsung has also begun working with PayPal to support mobile payments on wearable devices.

Though Samsung has not made an official entry into the mobile commerce market with its own payment service, the company is no stranger to the market itself. In 2012, Samsung partnered with Visa to released a special version of the Galaxy S3 smartphone, which supported Visa’s payWave technology. Last year, the companies expanded this partnership, bringing payWave supporting devices to 40 European countries. Rumors suggest that Samsung has also begun working with PayPal to support mobile payments on wearable devices.

Apple may find a strong competitor in Samsung

If Samsung decides to enter into the mobile commerce market, it may become Apple’s most significant competition. Apple released its own mobile payments service earlier this year, which has won praise among retail organizations and consumers alike. The service is only available for one iOS device, however, which has limited its appeal to some consumers. A platform developed by Samsung would likely be available for numerous Android devices, many of which Samsung has developed itself.

BWild |

December 19, 2014

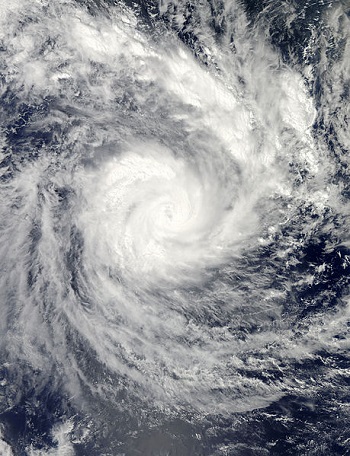

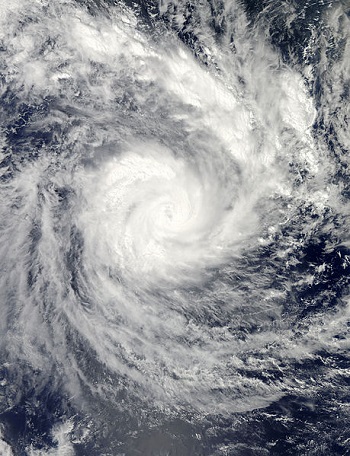

Farmers and other people across the Pacific Island nation are using smartphones to purchase necessary supplies.

Despite the fact that almost two years have passed since Samoa was devastated by Cyclone Evan, the Pacific Island is still working to recover from the catastrophe, and mobile technology has been playing a vital role in this process.

During the worst of the storm, winds reached up to 105 miles per hour, whipping the sheets of rain.

The waves were 13 feet high and storm surges were driven by the powerfully gusting winds. The World Bank created a post-disaster needs assessment following the storm and it showed that it was the agricultural segment of the country that experienced the greatest devastation. Over 7,000 families on the country’s Upolu island lost their livestock, crops, and farming equipment. The loss of income continues to hurt the communities that were dependent on agriculture. Programs have been set in place to help to recover and many now include the use of e-vouchers and mobile technology.

Mobile technology has provided massive relief in a system that has been piloted by the government in Samoa.

The program is based on the use of mobile device technology. Affected families have been provided with e-vouchers that can be used as payments for the replacement of farming supplies. The system works by transferring funds directly to the smartphones of the farmers, which have a special chip enabled within them.

The program is based on the use of mobile device technology. Affected families have been provided with e-vouchers that can be used as payments for the replacement of farming supplies. The system works by transferring funds directly to the smartphones of the farmers, which have a special chip enabled within them.

The system then allows those funds to be used for the purchase of over 5,000 specifically pre-approved “white listed” items that are sold from designated vendors. The items that have been authorized to be purchased by the farmers include building materials, as well as equipment for fishing and farming.

This represents the first time that the Pacific region has used this type of technology using mobile devices, and the practicality and cost effectiveness of the effort has been astounding. The risk of fraudulent use of the funds has been considerably reduced by linking the point-of-sale systems to the white listed products. Moreover, as it uses mobile technology, the electronic databases notably lower the need for paperwork. Those same databases also make it possible for improved and more reliable evaluation and monitoring of the program.

Though Samsung has not made an official entry into the mobile commerce market with its own payment service, the company is no stranger to the market itself. In 2012, Samsung partnered with Visa to released a special version of the Galaxy S3 smartphone, which supported Visa’s payWave technology. Last year, the companies expanded this partnership, bringing payWave supporting devices to 40 European countries. Rumors suggest that Samsung has also begun working with PayPal to support mobile payments on wearable devices.

Though Samsung has not made an official entry into the mobile commerce market with its own payment service, the company is no stranger to the market itself. In 2012, Samsung partnered with Visa to released a special version of the Galaxy S3 smartphone, which supported Visa’s payWave technology. Last year, the companies expanded this partnership, bringing payWave supporting devices to 40 European countries. Rumors suggest that Samsung has also begun working with PayPal to support mobile payments on wearable devices.

The program is based on the use of mobile device technology. Affected families have been provided with e-vouchers that can be used as payments for the replacement of farming supplies. The system works by transferring funds directly to the smartphones of the farmers, which have a special chip enabled within them.

The program is based on the use of mobile device technology. Affected families have been provided with e-vouchers that can be used as payments for the replacement of farming supplies. The system works by transferring funds directly to the smartphones of the farmers, which have a special chip enabled within them.