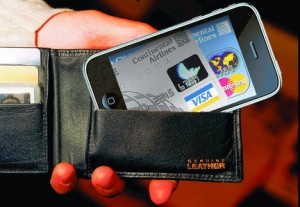

The mobile payments provider has announced its intentions to include near field communication.

Cellum, a mobile wallet provider from Europe, has announced that NFC technology is on its way to its services. Currently, its mobile payments services are based on Host Card Emulation technology. However, NFC is becoming increasingly commonplace in this market and a company press release revealed they’re joining in.

The company has successfully applied near field communication technology to services in the past.

According to Zoltán Ács, the Cellum director of research and development, “Until recently, Cellum focused on remote payments, though the company is no stranger to NFC, as it has had a number of successful implementations based on the technology in the past.” That said, Ács pointed out that when they had previously used NFC technology, the market hadn’t been “ready for it.”

Cellum believes the market has since evolved and is ready to adopt NFC technology based solutions.

He explained that by implementing NFC based mobile wallets, it will help to better meet a rising demand for secure, rapid and easy to use payment solutions. Cellum has become an official MasterCard Digital Vendor Partner through the Hungarian support of the launch of MasterCard MasterPass.

He explained that by implementing NFC based mobile wallets, it will help to better meet a rising demand for secure, rapid and easy to use payment solutions. Cellum has become an official MasterCard Digital Vendor Partner through the Hungarian support of the launch of MasterCard MasterPass.

Cellum provides banks and telcos with mobile wallet services that are MasterPass enabled. They also provider merchants with integration services that use its platform which is compliant with PCI DDS.

As MasterCard gets itself ready for its upcoming launch of contactless HCE based payments through its MasterPass, Cellum will offer its own partners the same functionality. Cellum COO, Ábel Garamhegyi, explained that the company has been using a white label model that included mobile wallet tech for several years. Garamhegyi went on to state that they have used it to established solid partnerships in Europe right through a good portion of the Asian market. He added that it gives the company pride to be “able to serve the diverse needs of our various clients and markets.”

The introduction of NFC technology will only expand on this capability as they broaden their reach as an official Digital Vendor Partner of MasterCard. This will bring together the one-touch PayPass experience with the online MasterPass convenience, all in a single branded app, said Garamhegyi.

Now that this has been accomplished, discussions on Reddit have shown that it leads to a brief message in Spanish. It translated to “Was that easy? Now that I have your attention, let’s make things more difficult.” To many fans, this pointed directly to Sombra as the next hero of the game. In Spanish, that name means “shadow.” This also helps to explain why the clue was hidden in the method chosen by the studio.

Now that this has been accomplished, discussions on Reddit have shown that it leads to a brief message in Spanish. It translated to “Was that easy? Now that I have your attention, let’s make things more difficult.” To many fans, this pointed directly to Sombra as the next hero of the game. In Spanish, that name means “shadow.” This also helps to explain why the clue was hidden in the method chosen by the studio.