MFS Africa is enabling millions of consumers to embrace mobile payments

A startup comprised of 30 people is helping accelerate the growth of mobile commerce in Africa. In 2009, MFS Africa began offering a new mobile payments platform, allowing consumers to use their mobile devices to complete transactions. The platform was embraced by some of the continent’s largest telecommunications companies, which account for more than 500 million consumers combined. With smartphone penetration on the rise throughout Africa, the demand for mobile payments services is growing quickly.

Remittance is being supported by mobile devices, allowing more consumers to send money back home more easily

According to the World Bank, remittances, money that foreign workers send home to their families, had increased in sub-Saharan Africa by 2.2%, reaching some $32.9 billion. Many consumers are beginning to use their mobile devices to send money back home, seeing these devices as more convenient than traditional remittance processes. MFC Africa has been enabling consumers to participate in mobile commerce of all kinds, which has also made the remittance process easier for consumers overall.

MFC Africa allows those with low-end mobile devices to participate in mobile commerce

While smartphone penetration is on the rise in many African countries, the majority of mobile consumers have conventional, low-end devices. MFS Africa has developed a platform that these consumers can use, ensuring the mobile commerce is not solely the domain of those with smartphones and other high-tech gadgets. The firm has allowed some 55 million people in 17 African countries to connect to one another. Approximately 15% of its users are considered active, making two or more mobile payments every month.

While smartphone penetration is on the rise in many African countries, the majority of mobile consumers have conventional, low-end devices. MFS Africa has developed a platform that these consumers can use, ensuring the mobile commerce is not solely the domain of those with smartphones and other high-tech gadgets. The firm has allowed some 55 million people in 17 African countries to connect to one another. Approximately 15% of its users are considered active, making two or more mobile payments every month.

As mobile payments grow, consumers are being targeted by groups that want to exploit financial information

The growth of mobile payments may represent some promising economic opportunities for companies operating in Africa. As consumers become more mobile-centric, businesses are feeling the need to provide mobile services to these consumers. One of the issues these organizations will have to overcome, however, is security. As mobile payments continue to grow, security is likely to become a more problematic issue for consumers.

BWild |

December 19, 2014

Farmers and other people across the Pacific Island nation are using smartphones to purchase necessary supplies.

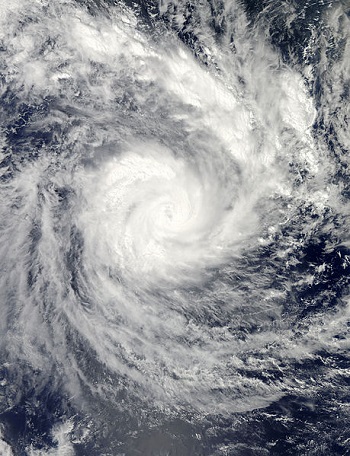

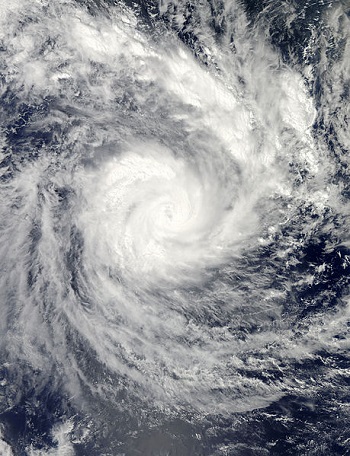

Despite the fact that almost two years have passed since Samoa was devastated by Cyclone Evan, the Pacific Island is still working to recover from the catastrophe, and mobile technology has been playing a vital role in this process.

During the worst of the storm, winds reached up to 105 miles per hour, whipping the sheets of rain.

The waves were 13 feet high and storm surges were driven by the powerfully gusting winds. The World Bank created a post-disaster needs assessment following the storm and it showed that it was the agricultural segment of the country that experienced the greatest devastation. Over 7,000 families on the country’s Upolu island lost their livestock, crops, and farming equipment. The loss of income continues to hurt the communities that were dependent on agriculture. Programs have been set in place to help to recover and many now include the use of e-vouchers and mobile technology.

Mobile technology has provided massive relief in a system that has been piloted by the government in Samoa.

The program is based on the use of mobile device technology. Affected families have been provided with e-vouchers that can be used as payments for the replacement of farming supplies. The system works by transferring funds directly to the smartphones of the farmers, which have a special chip enabled within them.

The program is based on the use of mobile device technology. Affected families have been provided with e-vouchers that can be used as payments for the replacement of farming supplies. The system works by transferring funds directly to the smartphones of the farmers, which have a special chip enabled within them.

The system then allows those funds to be used for the purchase of over 5,000 specifically pre-approved “white listed” items that are sold from designated vendors. The items that have been authorized to be purchased by the farmers include building materials, as well as equipment for fishing and farming.

This represents the first time that the Pacific region has used this type of technology using mobile devices, and the practicality and cost effectiveness of the effort has been astounding. The risk of fraudulent use of the funds has been considerably reduced by linking the point-of-sale systems to the white listed products. Moreover, as it uses mobile technology, the electronic databases notably lower the need for paperwork. Those same databases also make it possible for improved and more reliable evaluation and monitoring of the program.

While smartphone penetration is on the rise in many African countries, the majority of mobile consumers have conventional, low-end devices. MFS Africa has developed a platform that these consumers can use, ensuring the mobile commerce is not solely the domain of those with smartphones and other high-tech gadgets. The firm has allowed some 55 million people in 17 African countries to connect to one another. Approximately 15% of its users are considered active, making two or more mobile payments every month.

While smartphone penetration is on the rise in many African countries, the majority of mobile consumers have conventional, low-end devices. MFS Africa has developed a platform that these consumers can use, ensuring the mobile commerce is not solely the domain of those with smartphones and other high-tech gadgets. The firm has allowed some 55 million people in 17 African countries to connect to one another. Approximately 15% of its users are considered active, making two or more mobile payments every month.

The program is based on the use of mobile device technology. Affected families have been provided with e-vouchers that can be used as payments for the replacement of farming supplies. The system works by transferring funds directly to the smartphones of the farmers, which have a special chip enabled within them.

The program is based on the use of mobile device technology. Affected families have been provided with e-vouchers that can be used as payments for the replacement of farming supplies. The system works by transferring funds directly to the smartphones of the farmers, which have a special chip enabled within them.