Companies throughout that region are taking a closer look at wearable technology and are making investments.

Businesses throughout the Middle East are starting to look at wearables more seriously and this is being reflected in the growing investment that is being seen in these types of mobile devices.

That said, this doesn’t mean that there aren’t any more barriers in the way of the growth of this industry.

Organizations throughout the Middle East are increasingly starting to build business models based on the use of werables. Predictions from industry analysts are suggesting that over the next three years there will be substantial growth seen in the use and investment into wearable technology. Among the reasons that this industry is being driven forward is that there is a broader availability to the type of devices and features that are available, but also they are becoming more familiar.

As certain types of wearables become more mainstream, it opens the door to the adoption of others.

The region is about to see the launch of a whole new wave of everything from smartwatches to virtual reality headsets and even connected clothing. As a result, the wearable technology market in the Middle East and Africa (MEA) region is expected to see a growth rate of 56 percent from 2016 through 2019. This according to forecasts released by IDC.

The region is about to see the launch of a whole new wave of everything from smartwatches to virtual reality headsets and even connected clothing. As a result, the wearable technology market in the Middle East and Africa (MEA) region is expected to see a growth rate of 56 percent from 2016 through 2019. This according to forecasts released by IDC.

The fact that wearable technology devices are convenient, lightweight and small forms of mobile gadgets that allow people to complete various types of task either hands free or at least without having to take their smartphones out of their pockets, they have a considerable draw within the business community. Smartwatches are drawing a particularly large amount of attention as they can act as scaled down versions of smartphones combined with fitness trackers.

IDC MEA analyst, Feras Ibrahim explained that while the market for wearables is seeing a substantial growth, the hurdles that are still faced should not be forgotten or overlooked. Among the leading issues standing in the way is in the limited number of apps that are geared toward these tiny screen devices. Moreover, many of the designs are clunky or require a premium price point for a device that would suit business attire.

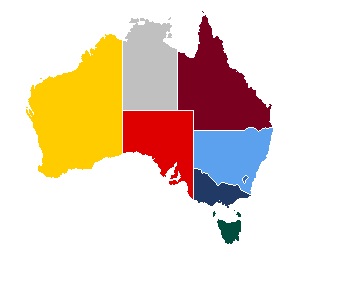

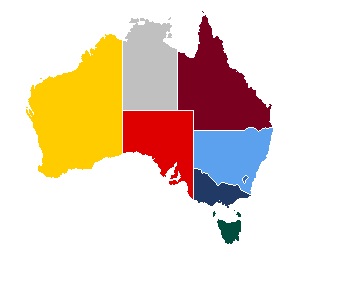

National Australia Bank is finding more momentum in the mobile payments space

Mobile commerce is gaining momentum in Australia, according to the National Australia Bank. The bank has announced that the uptake of new payment platforms has exceeded expectations, with some 18,000 consumers downloading the company’s NAB Pay application. This accounts for approximately 60,000 mobile transactions since the service was launched earlier this year. Other payment platforms are experiencing similar growth in the country as more consumers become comfortable with the concept of mobile commerce.

NAB Pay is gaining popularity among consumers interested in mobile shopping

The NAB Pay application is particularly popular among those purchasing lunch, coffee, and snacks. These consumers are using the app to make purchases at cafes and fast food restaurants at a higher frequency than those using contactless payment cards. During the work week, transactions made through NAB Pay spike during lunchtime and between 6pm and 7pm. As such, the vast majority of transactions are below $100, though some consumers are using NAB Pay to make larger purchases, especially those that are interested in electronics.

Companies are looking to make mobile payments more secure for consumers

Many banks in Australia have begun investing in mobile payments, hoping to provide better services to consumers with smartphones. These investments are beginning to focus on security features, hoping to make the mobile commerce space safer for consumers. Security has long been a major issue for consumers, many of whom believe that their financial information is at risk of exploitation. These concerns have prevented many people from participating in mobile commerce, but as payment services become more secure, many consumers are beginning to use their devices to shop online and in physical stores.

Many banks in Australia have begun investing in mobile payments, hoping to provide better services to consumers with smartphones. These investments are beginning to focus on security features, hoping to make the mobile commerce space safer for consumers. Security has long been a major issue for consumers, many of whom believe that their financial information is at risk of exploitation. These concerns have prevented many people from participating in mobile commerce, but as payment services become more secure, many consumers are beginning to use their devices to shop online and in physical stores.

National Australia Bank is establishing a strong position in the mobile commerce market

Australia is becoming a prominent mobile payments market, with several organizations looking to bring their new payment services to the country. The National Australia Bank is becoming a major player in this market, but will be competing with other organizations that have already established a foothold in this space.

The region is about to see the launch of a whole new wave of everything from smartwatches to virtual reality headsets and even connected clothing. As a result, the wearable technology market in the Middle East and Africa (MEA) region is expected to see a growth rate of 56 percent from 2016 through 2019. This according to forecasts released by IDC.

The region is about to see the launch of a whole new wave of everything from smartwatches to virtual reality headsets and even connected clothing. As a result, the wearable technology market in the Middle East and Africa (MEA) region is expected to see a growth rate of 56 percent from 2016 through 2019. This according to forecasts released by IDC.

Many banks in Australia have begun investing in mobile payments, hoping to provide better services to consumers with smartphones. These investments are beginning to focus on security features, hoping to make the mobile commerce space safer for consumers. Security has long been a major issue for consumers, many of whom believe that their financial information is at risk of exploitation. These concerns have prevented many people from participating in mobile commerce, but as payment services become more secure, many consumers are beginning to use their devices to shop online and in physical stores.

Many banks in Australia have begun investing in mobile payments, hoping to provide better services to consumers with smartphones. These investments are beginning to focus on security features, hoping to make the mobile commerce space safer for consumers. Security has long been a major issue for consumers, many of whom believe that their financial information is at risk of exploitation. These concerns have prevented many people from participating in mobile commerce, but as payment services become more secure, many consumers are beginning to use their devices to shop online and in physical stores.