Report highlights the aggressive growth of mobile commerce in the United States

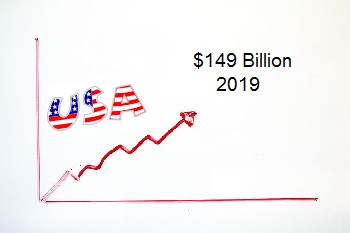

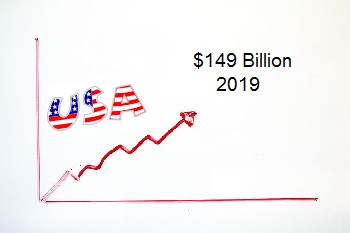

A new report from Forrester Research predicts that mobile payments volume in the United States will reach $149 billion in 2019, up from the $50 billion in payments volume currently. Mobile commerce is still a relatively new concept, only rising to prominence over the past few years. In a relatively short amount of time, consumers have become enthralled with the idea that they can make payments for products online and at physical stores with little more than their smarthphones and the demand for mobile-centric services is rising quickly.

Mobile payment services may become mainstream within the next five years

Several companies have been working to offer consumers mobile commerce services that are both convenient and secure, but none have yet been able to build a platform that has seen mainstream acceptance. Consumers seem to prefer using a wide variety of platforms and services, switching from one to the next as they see fit. Within the next five years, however, the report predicts that this will change and some platforms will become favored among consumers, while others may fade into obsolescence.

Retailers are feeling pressure to engage mobile consumers more effectively

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store mobile payments is growing quickly and retailers are feeling pressure to address this demand and engage mobile consumers. Some retailers are building their own mobile commerce platforms, while others reach out to companies like Apple and Google in order to connect with mobile consumers.

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store mobile payments is growing quickly and retailers are feeling pressure to address this demand and engage mobile consumers. Some retailers are building their own mobile commerce platforms, while others reach out to companies like Apple and Google in order to connect with mobile consumers.

In-store mobile transaction volume may reach $34 billion by 2019

The report predicts that Apple Pay will help accelerate growth in physical mobile payments. According to the report, in-store mobile transaction volume will reach $34 billion in the U.S. by 2019. Services like Apple Pay will play a considerable role in powering this growth. As retailers see more success with in-store mobile payments, they may choose to become more aggressive in the mobile commerce field.

Accenture survey highlights the growing prominence of mobile commerce

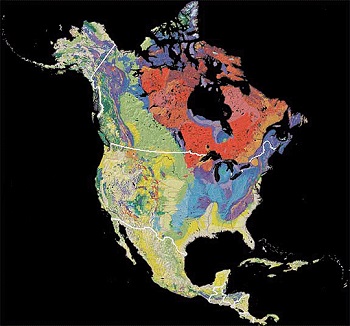

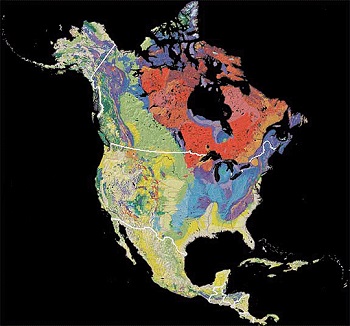

Accenture has released the results of a new survey comprised of data collected by 4,000 consumers in the United States and Canada. The survey highlights the growing interest people have in mobile payments and digital currencies. More people are beginning to base their lives on mobile technology, and the demand for mobile-centric services has been growing rapidly as a result. Several businesses are moving to become more mobile friendly, favoring strategies that engage mobile consumers more effectively.

40% of North American consumers are using their mobile devices to make payments at merchant locations

According to the survey, 40% of consumers in North America have used their mobile device to make a payment at a merchant location. This is a 16% increase over the number of people making mobile payments two years ago. The survey shows that millennials and high-income consumers are avid supporters of mobile commerce and digital currencies. High-income consumers, those with an average household income of $150,000, are the most aggressive adopters of digital payments, with 55% of these consumers using their mobile devices to make a purchase.

Growing number of consumers are showing favor for digital forms of currency

The survey also found that digital currencies are beginning to gain traction among consumers. Approximately 18% of those surveyed expect to be using some form of digital currency on a weekly basis by 2020. Many have shown favor for Bitcoin, as it is one of the most popular digital currencies currently available. High-income consumers are those most likely to use digital currencies in the coming years, with millennials accounting for the minority.

The survey also found that digital currencies are beginning to gain traction among consumers. Approximately 18% of those surveyed expect to be using some form of digital currency on a weekly basis by 2020. Many have shown favor for Bitcoin, as it is one of the most popular digital currencies currently available. High-income consumers are those most likely to use digital currencies in the coming years, with millennials accounting for the minority.

Mobile commerce has yet to become mainstream, traditional payments may continue to be the norm for some time

The survey predicts that traditional forms of payment will become less popular in the coming years. Respondents noted that they expect to reduce their use of cash from now to 2020, favoring mobile-centric forms of payment. Traditional payments may still be the norm for most consumers in North America, as it could takes years for mobile commerce to enter into the mainstream.

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store mobile payments is growing quickly and retailers are feeling pressure to address this demand and engage mobile consumers. Some retailers are building their own mobile commerce platforms, while others reach out to companies like Apple and Google in order to connect with mobile consumers.

People are becoming more reliant on their mobile devices. As such, they are looking for services that can offer them more than the ability to pay for products online. The demand for physical, in-store mobile payments is growing quickly and retailers are feeling pressure to address this demand and engage mobile consumers. Some retailers are building their own mobile commerce platforms, while others reach out to companies like Apple and Google in order to connect with mobile consumers.

The survey also found that digital currencies are beginning to gain traction among consumers. Approximately 18% of those surveyed expect to be using some form of digital currency on a weekly basis by 2020. Many have shown favor for Bitcoin, as it is one of the most popular digital currencies currently available. High-income consumers are those most likely to use digital currencies in the coming years, with millennials accounting for the minority.

The survey also found that digital currencies are beginning to gain traction among consumers. Approximately 18% of those surveyed expect to be using some form of digital currency on a weekly basis by 2020. Many have shown favor for Bitcoin, as it is one of the most popular digital currencies currently available. High-income consumers are those most likely to use digital currencies in the coming years, with millennials accounting for the minority.