Google wants companies to make mobile websites in order to keep their search engine rankings

Google is making changes to the way it ranks websites on its popular search engine. Such changes are not uncommon from the company, which often updates its ranking methodology to accommodate changing trends in various sectors. One of the most influential of these trends is the growing use of mobile technology. With more consumers using smartphones and tablets to browse the Internet, Google has issued a mandate for those ranked on its search engine to become more mobile friendly.

Companies have until April 21 to make mobile websites

Websites have until April 21 to meet Google’s standards concerning mobile friendliness if they do not want to receive a lower ranking on the company’s search engine. Large companies have already addressed the mobile friendly issue, making their websites easily accessible via mobile devices. Smaller businesses, however, may struggle to adopt to Google’s new search standards, as they may not have the resources needed to become mobile-centric. Mobile websites have become a powerful tool that can be used to engage a new generation of consumers.

Small businesses may see the most significant impact from Google’s new rules

Small retailers may see the greatest impact by not complying with Google’s new standards. These companies tend to operate their own websites, choosing not to use services like WordPress. As such, they often acquire the services of web developers and designers, whom are responsible for the functionality of these sites and how they look. Making a website mobile friendly can be a difficult and expensive task, which smaller companies may not be able to accomplish in the amount of time that Google has given them.

Small retailers may see the greatest impact by not complying with Google’s new standards. These companies tend to operate their own websites, choosing not to use services like WordPress. As such, they often acquire the services of web developers and designers, whom are responsible for the functionality of these sites and how they look. Making a website mobile friendly can be a difficult and expensive task, which smaller companies may not be able to accomplish in the amount of time that Google has given them.

Growing number of consumers opt to use their mobile devices to shop online

Consumers have shown that they favor companies that have mobile websites, as these sites are easier to navigate on smartphones and tablets. Companies that offer an enjoyable mobile experience tend to find more traction with mobile consumers, especially those interested in digital commerce. Mobile has become a major priority for the retail industry, which has seen a major increase in the number of consumers that are shopping from their mobile devices.

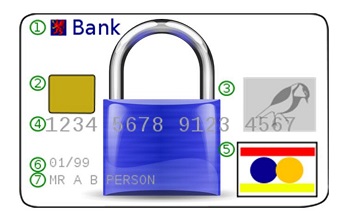

For those interested in mobile commerce, the new security standards could be seen as a boon. Security has long been an issue that the mobile world has had to manage, and the issue has become more important to address with the growing number of people using their smartphones to make purchases. The new point-of-sale terminals that retailers will have to adopt will support

For those interested in mobile commerce, the new security standards could be seen as a boon. Security has long been an issue that the mobile world has had to manage, and the issue has become more important to address with the growing number of people using their smartphones to make purchases. The new point-of-sale terminals that retailers will have to adopt will support