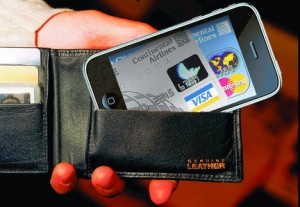

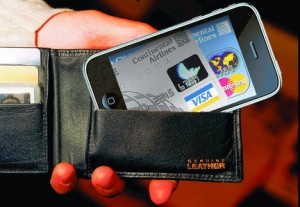

In China nearly two thirds of all shoppers are now regularly using wallet apps to complete purchase transactions.

A new report revealed that almost two out of every three Chinese consumers use smartphone mobile payments regularly. The report was aimed at better understanding the country’s internet development. China Internet Network Information Center conducted the study and revealed the results of its data analysis.

The report showed 64.5 percent of Chinese smartphone owners use mobile payments to buy products.

That figure represents about 424.5 million people in China. These figures are as up to date as June 2016, which represents some very recent insight into this smartphone mobile payments trend. It also shows an increase in usage of 7 percent since December.

Aside from mobile wallet use, the report on the study also stated that there are 710 million internet users in China. This is nearly double the entire population of the United States. An estimated 656 million internet users connect to it via mobile devices.

The rapid growth in smartphone mobile payments is credited to the quick development of the necessary infrastructure.

The ecosystem needed in order to implement mobile wallets was adopted very swiftly in China, said the report. Recently, Samsung Pay and Apple pay have also entered the mobile payments market in China. This has given the sector’s growth a shot in the arm.

The ecosystem needed in order to implement mobile wallets was adopted very swiftly in China, said the report. Recently, Samsung Pay and Apple pay have also entered the mobile payments market in China. This has given the sector’s growth a shot in the arm.

A rising number of manufacturers such as Xiaomi and Huawei launch NFC technology enabled smartphones. The result is a greater compatibility with many mobile payments tech requirements. Near field communication is the technology behind many large mobile wallets such as Apple Pay. The more consumers have NFC enabled smartphones, the greater the ability to actually use the mobile payment apps.

According to IDC research firm senior analyst, Michael Yeo, “Mobile payments have become a part of life in China now, driven by a combination of factors including e-commerce and mobile commerce, and services such as taxi-hailing apps.”

Yeo also explained that the success of smartphone mobile payments is as great as it is as the Chinese market is less influenced by legacy payment methods. Credit cards and banking cards are not as ingrained in Chinese society. Moreover, many people in the country use the internet exclusively over mobile devices.

The mobile payments provider has announced its intentions to include near field communication.

Cellum, a mobile wallet provider from Europe, has announced that NFC technology is on its way to its services. Currently, its mobile payments services are based on Host Card Emulation technology. However, NFC is becoming increasingly commonplace in this market and a company press release revealed they’re joining in.

The company has successfully applied near field communication technology to services in the past.

According to Zoltán Ács, the Cellum director of research and development, “Until recently, Cellum focused on remote payments, though the company is no stranger to NFC, as it has had a number of successful implementations based on the technology in the past.” That said, Ács pointed out that when they had previously used NFC technology, the market hadn’t been “ready for it.”

Cellum believes the market has since evolved and is ready to adopt NFC technology based solutions.

He explained that by implementing NFC based mobile wallets, it will help to better meet a rising demand for secure, rapid and easy to use payment solutions. Cellum has become an official MasterCard Digital Vendor Partner through the Hungarian support of the launch of MasterCard MasterPass.

He explained that by implementing NFC based mobile wallets, it will help to better meet a rising demand for secure, rapid and easy to use payment solutions. Cellum has become an official MasterCard Digital Vendor Partner through the Hungarian support of the launch of MasterCard MasterPass.

Cellum provides banks and telcos with mobile wallet services that are MasterPass enabled. They also provider merchants with integration services that use its platform which is compliant with PCI DDS.

As MasterCard gets itself ready for its upcoming launch of contactless HCE based payments through its MasterPass, Cellum will offer its own partners the same functionality. Cellum COO, Ábel Garamhegyi, explained that the company has been using a white label model that included mobile wallet tech for several years. Garamhegyi went on to state that they have used it to established solid partnerships in Europe right through a good portion of the Asian market. He added that it gives the company pride to be “able to serve the diverse needs of our various clients and markets.”

The introduction of NFC technology will only expand on this capability as they broaden their reach as an official Digital Vendor Partner of MasterCard. This will bring together the one-touch PayPass experience with the online MasterPass convenience, all in a single branded app, said Garamhegyi.

The ecosystem needed in order to implement mobile wallets was adopted very swiftly in China, said the report. Recently, Samsung Pay and Apple pay have also entered the mobile payments market in China. This has given the sector’s growth a shot in the arm.

The ecosystem needed in order to implement mobile wallets was adopted very swiftly in China, said the report. Recently, Samsung Pay and Apple pay have also entered the mobile payments market in China. This has given the sector’s growth a shot in the arm.

He explained that by implementing

He explained that by implementing